Your Work related travel expenses 2021 images are available in this site. Work related travel expenses 2021 are a topic that is being searched for and liked by netizens now. You can Get the Work related travel expenses 2021 files here. Get all royalty-free photos and vectors.

If you’re looking for work related travel expenses 2021 images information connected with to the work related travel expenses 2021 interest, you have come to the right site. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

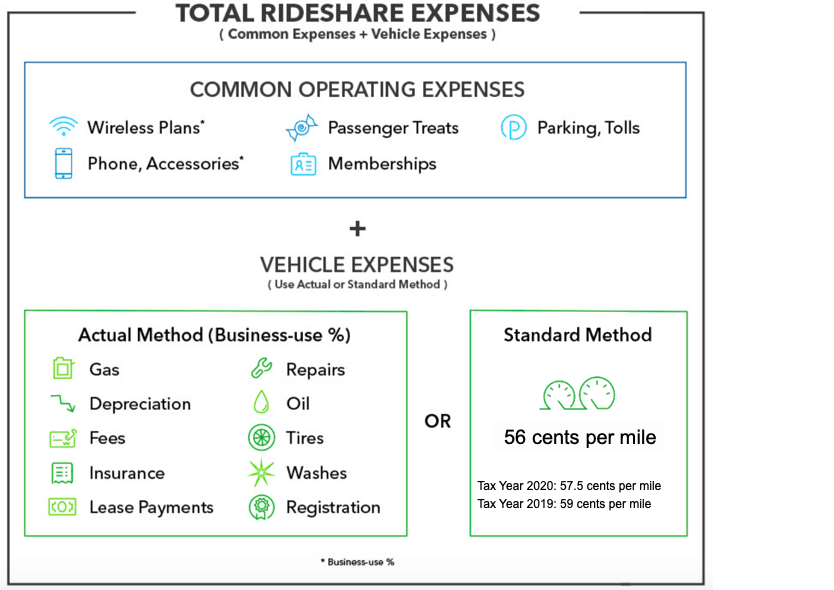

Work Related Travel Expenses 2021. S-Corporation Travel Expenses. GetApp helps more than 18 million businesses find the best software for their needs. Additionally the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2021. As detailed below there are different rules depending on what the expense was for and the rules that have to be met to be deductible.

Travel Expenses How To Claim Travel Deductions On Your Tax Return From etax.com.au

Travel Expenses How To Claim Travel Deductions On Your Tax Return From etax.com.au

However they recently announced a return to their normal review program for 2021 tax returns. S-Corporation Travel Expenses. Tips you pay for services related to any of these expenses. Parking fees tolls and travel by bus and train also qualify as business travel expenses. These expenses might include transportation to and. Expense Report - ExpensePoint Saves You Time And Money.

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 202122 financial year.

However they recently announced a return to their normal review program for 2021 tax returns. Ad Best Expense Management Software 2021 ExpensePoint. Approximately 85 million people claimed nearly 194 billion in work-related. Tips you pay for services related to any of these expenses. However they recently announced a return to their normal review program for 2021 tax returns. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Expense Report - ExpensePoint Saves You Time And Money. DOMESTIC TRAVEL EXPENSES INCURRED 1 July. However they recently announced a return to their normal review program for 2021 tax returns. S-Corporation Travel Expenses. 2021 Mileage Tax Deduction Rate.

Source: pinterest.com

Source: pinterest.com

GetApp helps more than 18 million businesses find the best software for their needs. Public transport air travel and. Even before COVID-19 remote work policies were rising in popularity. GetApp helps more than 18 million businesses find the best software for their needs. Our previously published article outlined how to claim working.

Source: investopedia.com

Source: investopedia.com

Additionally the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2021. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. The Australian Taxation Office has issued new rates for reasonable travel expenses for the 202122 financial year. MyTax 2021 Work-related travel expenses. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Source: litrg.org.uk

Source: litrg.org.uk

Tax Determination TD20216 sets out the rates for employee. You must have written evidence such as diary entries and receipts for your laundry expenses if boththe amount of your claim is greater than 150the amount your total. As detailed below there are different rules depending on what the expense was for and the rules that have to be met to be deductible. GetApp helps more than 18 million businesses find the best software for their needs. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year.

Source: template.net

Source: template.net

These expenses might include transportation to and. MyTax 2021 Work-related travel expenses. Public transport air travel and. Our previously published article outlined how to claim working. For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some.

Source: ecb.europa.eu

Source: ecb.europa.eu

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. Parking fees tolls and travel by bus and train also qualify as business travel expenses. Other similar ordinary and necessary expenses related to your business travel. The easiest way to calculate mileage tax deductions is by using the standard mileage rate set by the IRS.

Source: hrcabin.com

Source: hrcabin.com

Even before COVID-19 remote work policies were rising in popularity. Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. You cannot deduct commuting. As detailed below there are different rules depending on what the expense was for and the rules that have to be met to be deductible. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

Source: template.net

Source: template.net

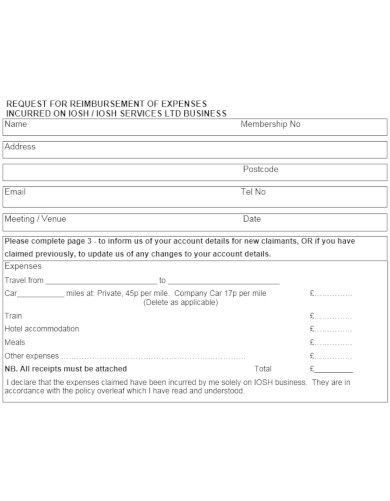

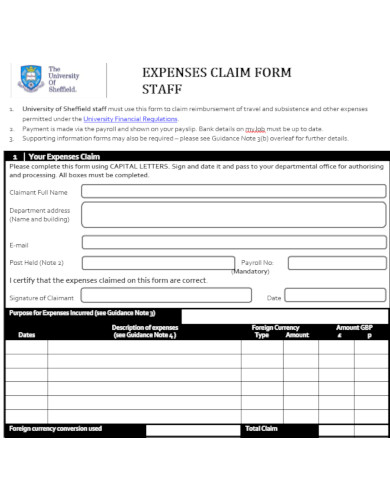

For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some. D2 Work-related travel expenses 2021. MyTax 2021 Work-related travel expenses. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Complete this section if you incurred travel expenses you incur in performing your work as an employee.

Source: blog.spendesk.com

Source: blog.spendesk.com

For the 2021 tax year the rate. D2 Work-related travel expenses 2021. The ATO is expecting to see an increase in work-related expenses due to higher working from home deductions. Meals qualify if they were related to a business trip or needed for a business. These expenses might include transportation to and.

Source: keepertax.com

Source: keepertax.com

S-Corporation Travel Expenses. MyTax 2021 Work-related travel expenses. These expenses might include transportation to and. D2 Work-related travel expenses 2021. Ad Stress Hassle Free Personalized Expense Management Tools Reviews - View Now.

Source: etax.com.au

Source: etax.com.au

The ATO is expecting to see an increase in work-related expenses due to higher working from home deductions. Ad Stress Hassle Free Personalized Expense Management Tools Reviews - View Now. Tips you pay for services related to any of these expenses. Our previously published article outlined how to claim working. You cannot deduct commuting.

Source: investopedia.com

Source: investopedia.com

Even before COVID-19 remote work policies were rising in popularity. DOMESTIC TRAVEL EXPENSES INCURRED 1 July. 2021 Work Related Travel Expensesdoc Special substantiation rules apply to expenses in relation to overseas and domestic travel. Expense Report - ExpensePoint Saves You Time And Money. 2021 Mileage Tax Deduction Rate.

Source: etax.com.au

Source: etax.com.au

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 202122 financial year. For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some. GetApp helps more than 18 million businesses find the best software for their needs. However they recently announced a return to their normal review program for 2021 tax returns. As detailed below there are different rules depending on what the expense was for and the rules that have to be met to be deductible.

Parking fees tolls and travel by bus and train also qualify as business travel expenses. Meals qualify if they were related to a business trip or needed for a business. You cannot deduct commuting. Complete this section if you incurred travel expenses you incur in performing your work as an employee. Tax Determination TD20216 sets out the rates for employee.

Source: paisabazaar.com

Source: paisabazaar.com

Ad Best Expense Management Software 2021 ExpensePoint. MyTax 2021 Work-related travel expenses. As detailed below there are different rules depending on what the expense was for and the rules that have to be met to be deductible. These expenses might include transportation to and. GetApp helps more than 18 million businesses find the best software for their needs.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title work related travel expenses 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.