Your Work related travel expenses images are available in this site. Work related travel expenses are a topic that is being searched for and liked by netizens now. You can Find and Download the Work related travel expenses files here. Download all royalty-free vectors.

If you’re searching for work related travel expenses pictures information connected with to the work related travel expenses keyword, you have visit the ideal site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

Work Related Travel Expenses. 511 Business Travel Expenses. Work-related travel expenses include costs for public transport taxis flights and more. Ad Centralize all expense data by integrating with your corporate travel management software. Public transport air travel and taxi fares.

Guide To Travel Related Work Expenses Afs Associates From afsbendigo.com.au

Guide To Travel Related Work Expenses Afs Associates From afsbendigo.com.au

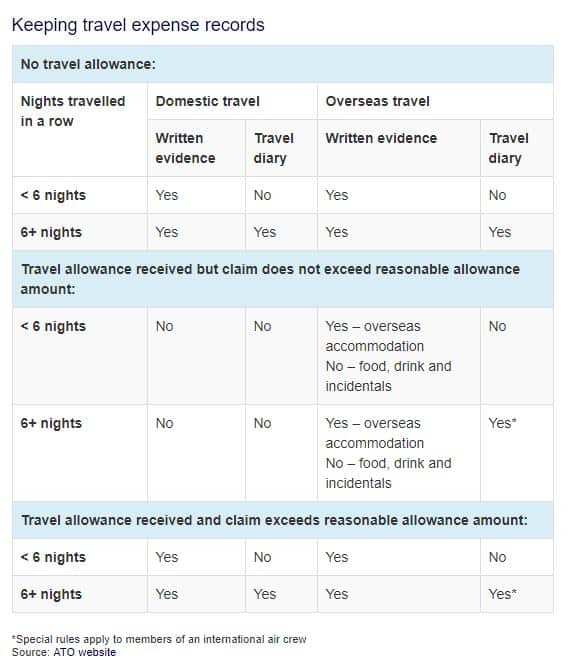

Expenses paid for lobbying activities cannot be deducted. Ad Auto-scan and digitally store your receipts and save more on paper. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. Ad Centralize all expense data by integrating with your corporate travel management software. Bridge and road tolls parking fees and short-term car hire. What are work related travel expenses ATO.

Employees can directly file TE expenses within G Suite Outlook text messages.

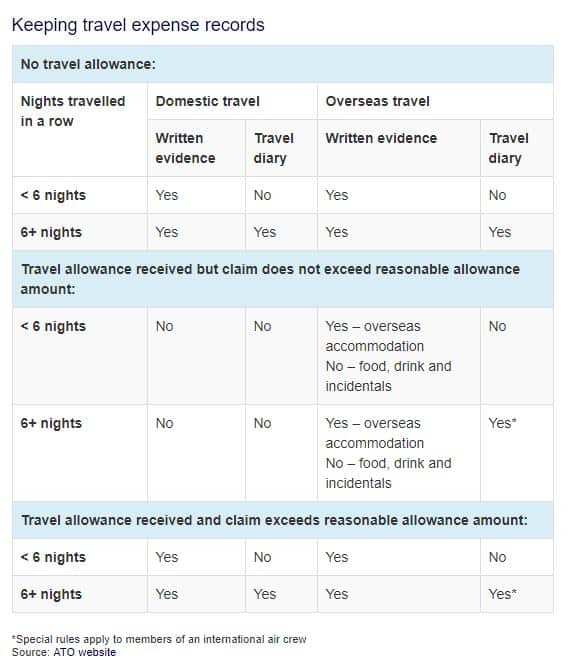

For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less. 511 Business Travel Expenses. Mileage expenses or car rental accommodation parking and tolls taxi or public transportation costs business center expenses copy fax. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Common travel expenses include among others.

Source: advivo.com.au

Source: advivo.com.au

Reimbursements employees are entitled to for work-related travel expenses can be somewhat convoluted. Make sure you claim what you are entitled to and boost your refund. Ad Provides Employees a Simple Way to Pay Finance a Unified Place to Track Control Spend. Employees can directly file TE expenses within G Suite Outlook text messages. Expenses paid for lobbying activities cannot be deducted.

Source: markspaneth.com

Source: markspaneth.com

Employees can directly file TE expenses within G Suite Outlook text messages. Common travel expenses include among others. If an organization is tax. D2 Work-related travel expenses 2021. Ad Provides Employees a Simple Way to Pay Finance a Unified Place to Track Control Spend.

Source: pinterest.com

Source: pinterest.com

Get Zoho Expense for Free. For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Mileage expenses or car rental accommodation parking and tolls taxi or public transportation costs business center expenses copy fax. Get Zoho Expense for Free.

Source: afsbendigo.com.au

Source: afsbendigo.com.au

Self-employed individuals may be able to deduct mileage if they travel for work. Lets explain how to turn work. Work related travel expenses can boost your tax refund. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less. Incidental expenses laundry etc Air bus train and taxirideshare fares.

Source: pinterest.com

Source: pinterest.com

D2 Work-related travel expenses 2021. Get Zoho Expense for Free. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Travel Expenses for Work. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year.

Source: pinterest.com

Source: pinterest.com

Ad Provides Employees a Simple Way to Pay Finance a Unified Place to Track Control Spend. Bridge and road tolls parking fees and short-term car hire. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Ad Provides Employees a Simple Way to Pay Finance a Unified Place to Track Control Spend. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less.

Source: pinterest.com

Source: pinterest.com

Expenses paid for lobbying activities cannot be deducted. Bridge and road tolls. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. If an organization is tax. Work-related travel expenses can include things like public transportation costs and vehicle rentals.

Source: travelperk.com

Source: travelperk.com

Work-related travel expenses can include things like public transportation costs and vehicle rentals. Make sure you claim what you are entitled to and boost your refund. Work related travel expenses can boost your tax refund. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less. Ad Centralize all expense data by integrating with your corporate travel management software.

Source: exceldatapro.com

Source: exceldatapro.com

Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Mileage expenses or car rental accommodation parking and tolls taxi or public transportation costs business center expenses copy fax. If an organization is tax. Bridge and road tolls. 511 Business Travel Expenses.

Source: vertex42.com

Source: vertex42.com

Ad Auto-scan and digitally store your receipts and save more on paper. Common travel expenses include among others. Self-employed individuals may be able to deduct mileage if they travel for work. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Public transport air travel and taxi fares.

Source: gofar.co

Source: gofar.co

Get Zoho Expense for Free. Incidental expenses laundry etc Air bus train and taxirideshare fares. If an organization is tax. Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job.

Source: agilisca.com.au

Source: agilisca.com.au

Ad Centralize all expense data by integrating with your corporate travel management software. In these cases if an employee uses their own cash checks or credit cards to pay for travel expenses you are required to reimburse them for the money theyve spent. Self-employed individuals may be able to deduct mileage if they travel for work. Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less.

Source: help.airtax.com.au

Source: help.airtax.com.au

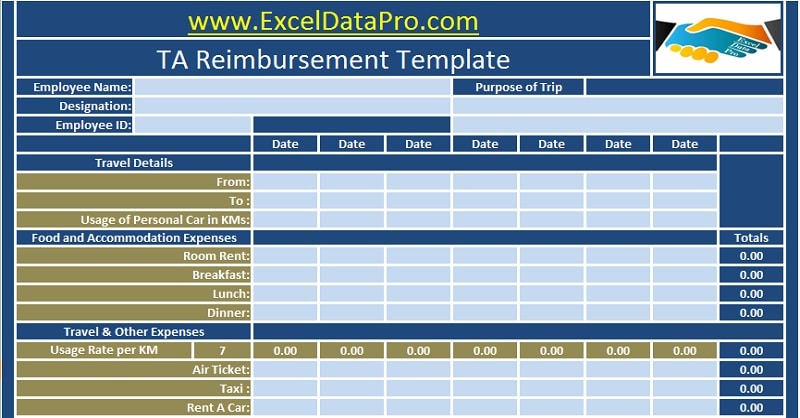

For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Incidental expenses laundry etc Air bus train and taxirideshare fares. For information about what expenses you claim as car expenses item D1 and what expenses you claim as travel expenses item D2 and some. Work related travel expenses can be claimed as tax deductions and when it comes to motor vehicle travel expenses you can claim through a series of methods subject to ATO.

Work related travel expenses can be claimed as tax deductions and when it comes to motor vehicle travel expenses you can claim through a series of methods subject to ATO. Ad Provides Employees a Simple Way to Pay Finance a Unified Place to Track Control Spend. Bridge and road tolls parking fees and short-term car hire. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year or less. With TripActions Liquid Save Time Money on Business Expenses Travel Reconciliation.

Source: sampleforms.com

Source: sampleforms.com

Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. D2 Work-related travel expenses 2021. Work-related travel expenses are deductible as long as you incurred the costs for a taxi plane train or car while working away from home on an assignment that lasts one year. Employees can directly file TE expenses within G Suite Outlook text messages.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title work related travel expenses by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.